On the Floor: What is Stopping Our Economy Falling into the Basement?

Writing about web page http://johnbtaylorsblog.blogspot.com/2010/02/one-year-later-and-more-evidence-that.html

A couple of months back, John Taylor made the point that the U.S. recovery is being led by the private sector. The vaunted $787 billion fiscal stimulus package passed by Congress has played no role. This is for a simple reason: it hasn't happened yet. This led Taylor, rightly, to wonder what will happen when it does come on stream, most likely in the middle of the recovery.

Now that the 2009 Q4 figures are available, it is interesting to ask the same question of the UK economy. Recovery has started, or at least the decline has stopped. Where is the improvement coming from? Is it coming from private demand or public spending? Is it coming from home or abroad?

The chart shows the changes in the main components of GDP, in real terms, since 2008 Q1:

Source: ONS. G is general government consumption, NX is net exports, DInvent is the change in inventories, C is household consumption, and GFCF is gross fixed capital formation. Omitted are final consumption not by households, and net acquisitions of valuables.

The main picture is clear. Domestic private demand has collapsed. Until recently our economy was being held up partly by government consumption -- and even more so by foreign demand. (You might be surprised by that, given recent doom and gloom about the UK balance of trade. And there is a downside, which we'll come to.) The fact is that, from mid-2008 to mid-2009, the biggest support for the UK economy came from net exports.

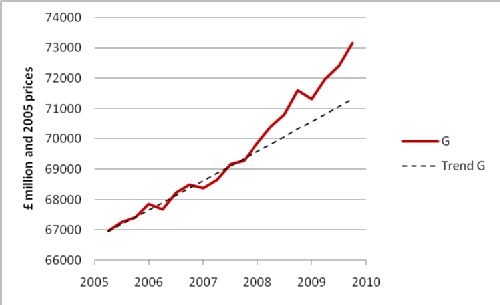

Right now, however, government consumption is what is holding the economy up. I think the John Taylor question for the UK would be: Is the action on public spending currently any more than was already in the pipeline before the crunch? In other words, is active intervention or passive drift at work? This question is answered by the next chart, which strongly suggests active intervention:

Source: ONS. G is general government consumption. The trend is log-linear, calculated over 2005 Q1 (i.e. the last quarter of the previous Parliament) to 2007 Q4 (i.e. the last quarter before the GDP decline set in).

The chart shows clearly that, from the onset of the crisis, public spending began to move sharply upward from the trend established over the previous quarters going back to the last general election.

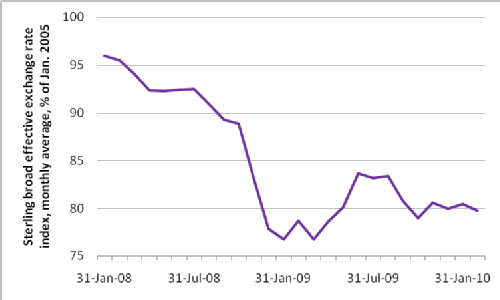

Another question is: How can we account for the net stimulus from trade, at a time when global demand was collapsing as fast as or faster than demand at home? There are two candidates: the foreign fiscal stimulus, and the domestic monetary stimulus. The deciding factor here is the real exchange rate. If global demand did the trick, boosted by the foreign fiscal stimulus that the G20 coordinated from the G20 last year, then the improved real trade balance should have been accompanied by an unchanged or rising real exchange rate. If it was quantitative easing pursued by the Bank of England, then we should see a declining real exchange rate. In the latter case, we saved ourselves by grabbing more than our share of global demand through competitive devaluation.

The next chart shows it was the Bank of England and competitive devaluation that did it.

Source: Bank of England. The series plots the broad sterling effective exchange rate monthly average.

The 30% decline in the real exchange rate through 2008 implies UK monetary policy was doing the larger share of the work. We grabbed a lifebelt, while others were beginning to drown -- Greece, lashed fast to the Euro, among them.

At the end of 2008, however, the depreciation of sterling came to an end. As a result, we are now even more dependent than we were a year ago on public consumption to hold up the economy. As the first chart shows, since the recovery began, the contribution of the trade balance has ceased to be positive. While household consumption and inventories are now showing small positive contributions, fixed investment is falling again. It's not a good picture.

What does this mean, given the public spending cuts now in prospect, whoever wins our coming elections? In principle, the real effect of public spending cuts on aggregate demand should not be entirely negative; lower government consumption should bring down interest rates and this should stimulate Britain's export sector through further currency depreciation. The trouble is that interest rates are already close to zero, and cannot fall further. Like the real economy itself, interest rates are on the floor but, unlike the real economy, cannot fall into the basement. For this reason it's hard to see how public spending cuts will translate quickly into improved prospects for recovery.

I understand that Britain has already too much public debt, of course, and will have to add to it in order to maintain public spending. We cannot do this without the cooperation of the lenders! This is why it is essential to plan for deficit reduction over the medium term.

At the same time, it is clear that the spending cuts in prospect are likely to cause double pain: not only a reduction in the level of public services, but also damage to the recovery of the real economy. Whatever government is in power, these are reasons to be very, very careful.

Mark Harrison

Mark Harrison

Loading…

Loading…

Add a comment

You are not allowed to comment on this entry as it has restricted commenting permissions.