All 1 entries tagged Syria

View all 3 entries tagged Syria on Warwick Blogs | View entries tagged Syria at Technorati | There are no images tagged Syria on this blog

August 29, 2013

History suggests intervention in Syria will be bad for business

Writing about web page http://theconversation.com/history-suggests-intervention-in-syria-will-be-bad-for-business-17611

Since last week’s gas attack on a Damascus suburb, the political class has been gripped by the idea that “something must be done.” Meanwhile Wall Street, already declining through early August, fell further as this week began. At the same time oil prices have ticked up sharply, not because Syria is a significant oil producer, but in response to fears for Middle Eastern supplies generally.

A military attack on Syria would clearly affect stock values. War diverts trade: some businesses lose while others gain. Is war good for business in the aggregate? Not likely. When an economy is depressed, and the fighting is at a comfortable distance, additional military spending might give a short-run stimulus to business for everyone. In the long run, however, war is a wealth-destroying activity. Because stock values reflect long-run profit expectations, the chances of a positive aggregate effect from hostilities are vanishingly improbable.

It is a somewhat different question whether the launching of an attack will move stock values on the day. Cruise missiles rarely come from a blue sky. Those for whom war has clear implications will usually have looked into the future and hedged their bets.

On the day the fighting starts, it is true, war changes from a probability to a certainty. But if the probability was already seen as close to 100%, the impact on asset values will inevitably be small. Only a true surprise would move them by much.

Economic historians first became interested in this topic in connection with World War I, the outbreak of which was a surprise to many. Niall Ferguson (in the Economic History Review 59:1 (2006)) and others (Lawrence, Dean, and Robert in the Economic History Review 45:3 (1992) have documented that as the war began European bond prices fell and unemployment rose in London, Paris, and Berlin. The panic on Wall Street was so great that the New York Stock Exchange was closed for the rest of the year.

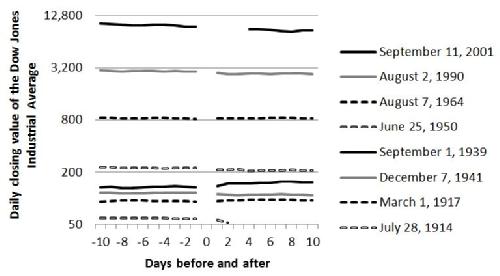

To update the record across the last 100 years, the chart below shows closing values of the Dow Jones Industrial Average in New York for the ten working days before and after eight war onsets (the value on the day itself is omitted).

Source: Mark Harrison, "Capitalism at War," forthcoming in The Cambridge History of Capitalism, edited by Larry Neal and Jeff Williamson for Cambridge University Press. [Thanks to Christopher Renner for drawing my attention to a misprint and a small error in the first version of this chart.]

The days shown are:

- September 11, 2001: Al-Qaeda attacks American cities

- August 2, 1990: Iraq invades Kuwait

- August 7, 1964: Gulf of Tonkin Resolution

- June 25, 1950: North Korea invades South Korea

- December 7, 1941: Japan attacks Pearl Harbor

- September 1, 1939: Germany invades Poland

- March 1, 1917: The Zimmermann telegram published

- July 28, 1914: Russia mobilises against Germany

Only two of these events saw stock prices climb, and then only slightly. In five cases they fell, and in two the stock market was closed (for more than four months after the outbreak of World War I in Europe, and for four days after 9/11).

Notably, although stock prices rose a little after Hitler’s attack on Poland in 1939, they fell thereafter. When Pearl Harbor arrived, they remained below the level recorded two years earlier. The median change in stock prices over the eight crises was a 5.3% decline.

Contrary to commonly held opinion, war has also been bad news generally for the very rich. Tony Atkinson, Thomas Piketty, and Emmanuel Saez have collected historical data on top incomes in many countries across the twentieth century. These show sharp wartime declines in the personal income shares of the very rich in every belligerent country for which wartime data are available.

This does not rule out the idea that a few corporations gain business, and a few people become richer as a result of conflict. It just tells us that the average effect goes the other way. Besides, war is always first and foremost a political act. If Western bombs fall on Damascus in the next few days, it will be because someone decided it made good politics, not good business.

Mark Harrison does not work for, consult to, own shares in or receive funding from any company or organisation that would benefit from this article, and has no relevant affiliations.![]()

This article was originally published at The Conversation. Read the original article.

Mark Harrison

Mark Harrison

Please wait - comments are loading

Please wait - comments are loading

Loading…

Loading…