All 1 entries tagged National Debt

No other Warwick Blogs use the tag National Debt on entries | View entries tagged National Debt at Technorati | There are no images tagged National Debt on this blog

March 31, 2011

Coalition supporters talking up the debt problem

Coalition supporters are exaggerating the debt problem. They have not got a democratic mandate from the election and the only argument they have in favour of cutting public expenditure is sheer economic necessity. There is no alternative, as Margaret Thatcher said of her rather similar policy.

The size of the deficit is undoubtedly a problem, the difference between tax receipts and public expenditure is at almost unprecedented levels due to the recession causing a sudden fall in tax revenue. This is a problem that needs addressing because it is unsustainable. It cannot be allowed to go on indefinitely. Labour says the deficit should be halved in four years, while the government say it can be eliminated completely by the end of the parliament without harming the economy.

But whatever our policy on the deficit, we should be clear about what we are talking about. Having a deficit is not the same as having a high national debt.

But coalition politicians are taking figures from the national debt and using them out of context to scare us. They use figures on the national debt inappropriately.

They all say that interest on government debt is costing us £120 million A DAY. They always stress the A DAY bit. It sounds a lot. But it is out of context. It translates to about £43 billion in a year. But that is only 3 percent of GDP. (In 2010 GDP was estimated to be £1454 billion.)

Interest payments of 3 percent is a very small figure in fact. (And anyway about 70 percent of government debt is held by UK residents. We are paying this interest to ourselves not foreigners, but that is another matter.)

Furthermore, the UK national debt is not actually high, either by historical standards or internationally. So it is disingenuous to complain about it.

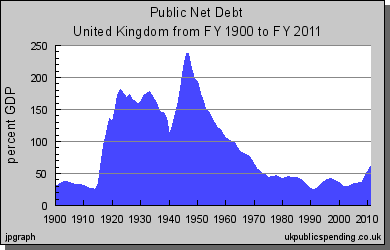

National debt fluctuates quite widely over the years but it has never been so large that there was a problem financing it, and the UK has never defaulted. The highest level of national debt was just after the second world war when it was almost 240 percent of gross domestic product. (Interestingly the baby boomers 'inherited' a much higher level of debt than today's.) It came down steadily until it reached its lowest level in recent years, 25 percent in 1991. It started to go up again and reached 42 percent in 1997 when Labour was elected. Gordon Brown's prudence got it back down to 29 percent in 2002. It was 36 percent in 2008 before the financial crash and is now increasing rapidly. The estimate for 2011 is 60 percent. But this is still a relatively low figure, as the following graph shows.

Dennis Leech

Dennis Leech

Please wait - comments are loading

Please wait - comments are loading

Loading…

Loading…