All 18 entries tagged Uss

View all 19 entries tagged Uss on Warwick Blogs | View entries tagged Uss at Technorati | There are no images tagged Uss on this blog

January 28, 2021

Pension scheme valuation versus pension funding and the cost of prudence (with reference to USS)

My argument in this latest draft of my paper on pensions valuation and funding (pensionsvaluation5.pdf) is relevant to all defined benefit schemes, of which there are still over 5300. It is aimed primarily at the regulator, who is faced with a siituaton of worsening deficits, and secondly at the actuarial profession. It is also directed at all who are involved in the valuation of the University Superannuation Scheme, whether executive, directors or the stakeholders UCU or UUK.

According to the latest Purple Book published by the Pension Protection Fund, total combine deficits of all DB pension schemes as at March 2020, have reached £90.7 billion last year compared with £12.7 billion the year before. This is before the effects of covid-19 have been felt and more and more schemes have to depend on the PPF.

The pensions crisis, that has been getting worse for a number of years, and has led to many schemes closing to new accrual, is exacerbated by a regulatory system requiring market price valuations, combined with very low gilt rates (due to government monetary policy/ quantitative easing) used to calculate liabilities. But this is not the only methodology that can be used: it is aimed at ensuring schemes with weak employer support have enough assets they can liquidate to pay the pensions should they have to close. But for an open scheme with a strong employer covenant it is very misleading and leads to cost increases that undermine it. For an open scheme it is better to make a direct analysis of funding needs comparing projected investment earnings with benefit outgo (something that actuaries did in the past).

Where there is a very large and significant difference between the se two methodologies is in the risk metric that determines the cost of prudence. The mark-to-market methodology must use a very much greater risk allowance - due to the much greater volatility of asset market prices as compared with investment earnings. This means that the regulatory system we are using artificially inflates the cost of prudence. It contains a serious bias that makes schemes appear much more expensive, and deficits much bigger, than would be the case if they were valued as open schemes.

This is a serious issue for the USS which has so far stuck religiously with the mark-to-market methodology despite it being an open scheme with a strong multi-employer covenant. Stakeholders should demand a re-appraisal using the traditional actuarial methodology before reaching any conclusions about the future of the scheme.

December 17, 2018

USS Institutions Meeting very disappointing

Last week was the annual USS Institutions Meeting, an opportunity for employers to be updated about the state of the pension scheme.

I attended as an elected member-nominated rep on the Advisory Committee (part of the formal USS governance structure). Attendees were invited to submit a question. I was disappointed that mine was not addressed but instead a heavily edited version substituted - and even that was not fully answered. My question was addressed to the chief executive, Bill Galvin, but the substitute question was answered by the actuary.

At bottom the issue facing the USS and the focus of the dispute is intellectual: a matter of methodology. A pension scheme must have sufficient funding to cover its liabilities when they fail due to be paid. That is obvious but there are different ways of assessing a scheme's ability to fund its pension payments over the years. However the law only requires the trustees to report on one of them, the Statutory Funding Objective, which requires the assets must be at least equal to the actuarial valuation of the liabilities known as the technical provisions, otherwise there is a deficit that must be filled by a recovery plan.

The actuarial profession is not united that this method - valuation - is necessarily the right approach and that it may be problematic. Many actuaries instead advocate projecting the flow of income - from both contributions and investments - to see if it will cover the flow of future benefits. I wanted to cite an important reference critiquing the valuation method: the paper by Simon Carne, which shows that the projection method is perfectly rigorous.

I wanted to show that it makes perfect sense to use both methods to get a rounded view. And Bill Galvin had previously accepted the point when I had asked a similar question two years ago. But it was evident that the the USS executive and the board are committed to one and only one valuation.

Here is my question:

The USS seems to be wedded to a single approach to funding via valuation, using ideas from financial economics. But that is not the only one. Another, equally valid method is available: the budgeting approach traditionally used by actuaries based on projected income and outgo. Simon Carne, in his seminal paper “Being Actuarial with the Truth”, showed this method to be perfectly rigorous and most of the claims of financial economists against it to be false. For a scheme with a strong covenant like the USS it has the advantage of avoiding the use of volatile asset prices and problematic discount rates.

It answers the question: by how much is the pension fund in surplus or deficit on the premise that the existing investment strategy is maintained, with all future reinvestment following the current investment strategy? It would be useful for the USS to know the answer to that question, in addition to the valuation. This method - which does not depend on discount rates driven down by the artificialities of the government’s quantitative easing policy, nor the market risk introduced by excessive asset price volatility - has been advocated by First Actuarial and applied to many schemes, including USS, showing only small deficits or surpluses.

At this meeting two years ago I asked if you would use this approach as a supplement to the statutory valuation. Bill Galvin replied: “Triangulation of different approaches is very much part of our first principles approach, with the use of a number of different lenses rather than a single lens; then we are very open to that as well.”

Can I please ask that you report the results of using this approach to determine the level of funding?”

Here is the question that was put to the scheme actuary, who was easily able to dismiss the suggestion of an alternative approach. It did not seem from his answer that he had seen the original question.

This illustrates a great weakness of the current management of the USS: that it fails to engage with the intellectual arguments surrounding pensions. Since the USS is the pension scheme for universities, it might be expected that the trustees, most of whom are academics, would be keenly interested in the arguments about actuarial practice and financial economics that have been going on for over twenty years, in order to try to get a better understanding. But no, they seem to want to manage the scheme as if there is nothing to question about the methodology, and their job consists in little more than unthinkingly applying the rules designed essentially for small commercial companies. It is unfortunate that academics and others who are thinking about these crucial methodological questions are not being taken seriously by the management. It is hard to avoid the conclusion that the USS has become a scheme FOR universities rather than a true university scheme.

June 25, 2018

Pensions: A sustainable social contract

Pension schemes are often described disparagingly – without evidence – as being unsustainable or unfair between generations, or even according to some people, a kind of fraud, a form of Ponzi scheme. That is because they are fundamentally intergenerational, in that pensions require the working generation to supply goods and services to the retired. That is inescapable and therefore all pensions are essentially pay-as-you-go in this sense.

This paper pensionssocialcontract.pdfcalculates the investment returns required for pension schemes on various assumptions and finds that if they are properly designed they are perfectly sustainable given the typical investment returns that are currently achievable.

It is important to note that the rate of interest on government bonds, ‘gilts’ – which are presently very low due to government policy known as ‘quantitative easing’ and such – is not the same as the rate of return on investments. Investment returns on equities and property are determined in the market and not related to government-policy driven interest rates.

The USS chief executive Bill Galvin has recently issued yet another statement in which he argues the opposite. He says that the cost of future accrual in the scheme is as much as 37.4 percent of salary. It is hard to accept such a high figure without a proper explanation. It would be good to know what lies behind it.

November 23, 2017

Is the USS really in crisis?

Threat to the defined benefit pension scheme

The employers have said that they want to close the USS defined benefit pension (DB) scheme to future accrual, which means that new members will not be allowed to join, and existing members will not be able to contribute any more into it than they have already built up. Future pensions contributions will all go into a defined contribution (DC) pension pot via the Investment Builder.

Defined benefit pensions are much cheaper and less risky

This is a very bad decision because DB pensions are much better than DC ones. They are a guarantee of a secure 'wage' in retirement for life, whereas a DC pension scheme works differently: it gives a single sum of money on retirement which you have to turn into an income. And pension freedom puts you in the position of having to take some very serious decisions about what to do with this pot of money that will affect the rest of your life. A lot can go wrong, especially as a result of poor financial advice, and you may have to live out your retirement with the consequences of one bad decision.

A DC pension is risky because how much your 'pot' is worth depends on the vagaries of the stock market. Academic research has shown that it costs between fifty percent more and double to provide a given secure income in retirement via a DC pension scheme than than DB.

Essentially, there is less risk in a DB pension because of the collective nature of the scheme. None of us knows when we will die, which is the biggest risk facing us if we are having to live off a DC 'pot': if we do our 'drawdown' sums wrong we might run out of money before we die, or leave unused retirement money as an unplanned legacy if we die earlier than planned. (It is actually rather far fetched to believe we can plan for our retirement in this way.) But actuarial life expectancy tables solve this problem in a DB scheme: the longevity risk is simply pooled.

Likewise it is much less costly to build up a DB than a DC pension because the investments are pooled in a large diversified portfolio, exploiting economies of scale and the law of averages which are not available to a DC fund.

A pension is a 'wage' in retirement for life. A DB scheme is designed to provide that while a DC pension does not. A DC scheme is really an employer-subsidised saving scheme. How you turn the savings you have built up into a pension is another matter that you have to decide and that is not easy or cheap.

The source of the problem facing USS

Contrary to what a lot of people think, the USS is not a government scheme backed by the taxpayer, like the teachers, civil service, health service and others. It is a private scheme run and regulated like a company scheme. It comes under the Pensions Regulator in the same way as, for example the schemes at BT, Royal Mail, British Steel, BHS, etc. Like all these it is 'funded' which means, in effect, that it must stand on its own feet, that its trustees must be able to show the regulator that it will have enough funds to pay the pensions members have been promised and expect every month after they have reitred.

The source of all the controversy about valuing the scheme is the interpretation of the phrase 'enough funds to pay the pensions'. Does that mean a capital sum or a flow of income? The difference has a big effect on how much risk there is.

The UUK have said the scheme must close because it is in deficit, the deficit is growing and that is unsustainable because it means the institutions will have to make ever larger recovery payments.

Let us examine the claims of the UUK. First, the scheme is not in deficit in the ordinarily meaning of the term. Second, there is no evidence that investment returns are too low for the scheme to be sustainable. Third, the scheme is sustainable as long as it remains open and continues into the future along with the universities it serves. Fourth, it is highly questionable that there is a deficit even in the narrow technical meaning in which the word is being used here.

Where is the deficit?

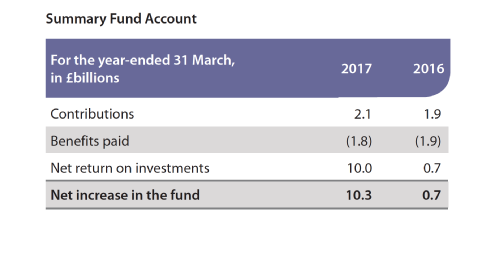

Figure 1 (below) taken from the USS Annual Report for 2017 shows the income from contributions and investments and payments of benefits. It shows that there is not actually a deficit in the usual meaning of the word. Income from contributions by employers and members totals £2 bn, while pensions in payment come to £1.8 bn. In addition it made a return on its investment portfolio of £10 bn (mostly this was from market price movements but that figure includes over £1 billion in dividends, interest, rent etc).

We usually think of a deficit in the George Osborne sense of not enough money coming in to pay the outgoings, necessitating selling assets or borrowing more. The USS is clearly not in deficit. It is cash rich and every year investing its surplus in new assets such as Thames Water, Heathrow Airport, and many other infrastructure projects in addition to traditional assets like company shares and bonds.

Figure 1: Deficit?

Will there be a deficit in the Future? Here we must enter the realm of intellectual speculation and deal with economic theorising, market fundamentalism and evidence-free opinion

Looking at one year's figures is not enough since they may not be typical and we need to look into the future. We need to find a way of seeing if there will be enough money to pay the pensions when they come due.

It is not obvious how that can be implemented. We have to do a thought experiment.

Consider a pension payment to a young lecturer early in his or her career, when he or she has retired, say in 50 years from now. There has to be enough funds to pay that. The pension can be forecast on assumptions about longevity, salary growth, inflation and other factors. But how can we tell if will be enough money? One approach is to ask how much will be needed to be invested today to give enough in 50 years to pay the expected pension.

Since the trustees have to be sure that the money will be there, they must be prudent in their assumptions. How prudent is prudent enough? Since nothing is ever certain, if they wish to be very prudent, they cannot rely on contributions from employers or members in the future. Theoretically the scheme could close (maybe all the member institutions go under for some reason we do not yet know) and there could be no contributions. So it is arguably best to err on the safe side and make this assumption.

And they have to decide how the money is invested to pay the pension in 50 years. Since nothing is certain in investments it would be imprudent to rely on risky assets like equities, even though they are almost certain to grow handsomely in a long enough period. Prudence - paradoxically - requires investing in secure bonds, which have a poor rate of return. At the moment the rate of return on government bonds is at a record low level due to the government's policy of quantitative easing.

If we do this calculation for all prospective pension payments, we get a figure for the liabilities. Comparing that with the value of the assets the scheme owns gives the funding level or deficit/surplus.

The liabilities figure is very large because it is based on the very powerful arithmetic of compound interest over long periods of time. It is also very sensitive to assumptions made - for the same reason. And it must ignore a host of real world factors that can change dramatically. The figure for the deficit is very inaccurate and volatile since it is the difference between two very large numbers, the liabilities and the assets, both of which are highly volatile.The deficit figure quoted by the UUK and USS executive has changed by over £2billion in little over two months. This fact alone suggests that this way of valuing the scheme is unreliable: the actual value of the benefits can not have changed in that time by more than a miniscule amount.

Another other problem with this approach, that has not been sufficiently discussed, is that it begs the question of how the capital value of the assets is to be converted into money to pay the pensions - that is, an income stream. That process needs to be spelled out and not just assumed. Can a scheme as big as the USS just sell assets on a large scale if need be without disturbing the market? It seems unlikely.

Are investment returns really too poor?

The UUK give one of the reasons for the deficit that investment returns have fallen. It is certainly true that gilt rates are at the lowest they have ever been, lower than inflation. It would not really be sensible for a rational investor to invest in gilts since that would guarantee losing money. But other investments, particularly equities, produce a good return that would seem to be enough for the pension scheme to continue to be viable, if it continued to invest in them.

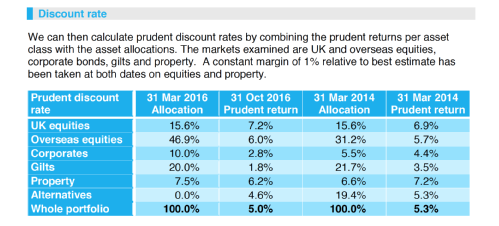

Figure 2 below shows the estimated returns on different investments that were prepared for the UCU by its actuary, First Actuarial. They contain a suitable margin for prudence to enable them to be the basis of a discount rate. The returns have fallen dramatically to low levels on bonds particularly government bonds.

Figure 2: Poor investment returns?

Is the USS unsustainable?

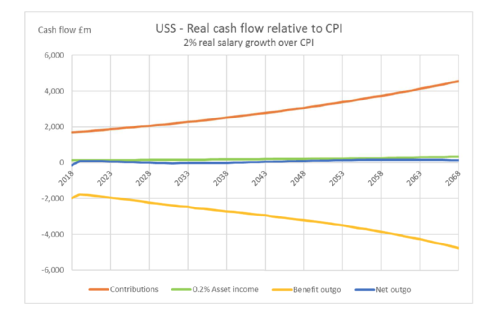

Another thought experiment is to ask if there is likely to be enough cash flow to pay the pensions, based on a projection of income from contributions and investment earnings and liabilities. This is a natural, direct approach that requires less in the way of assumptions than the capitalisation approach described before. In particular it does not require a discount rate for compound interest calculation.

Figure 3, below, shows projected cash flows for the USS that have been prepared for the UCU union by its actuaries (First Actuarial). This is just one of a number of scenarios that have been studied but all show the same picture (2% real salary growth, real asset income of 0.2 percent). It is clear that from this point of view, where the scheme remains open indefinitely, in the same way as is highly likely the pre-92 university sector will, the pension scheme will be perfectly sustainable, having a small deficit or surplus.

Figure 3: Unsustainable?

Is the scheme in technical deficit or is it in surplus?

There is a fundamental difference in the methodology between the situation where the scheme is assumed to be open indefinitely and where it is assumed to be getting prepared to close. In the latter case it must find a way of ensuring it is funded at all times, or at least as soon as possible while it can rely on the employer being able to support it. Volatility of the technical 'deficit' due to market fluctuations in asset prices represents risk here. The risk is that the scheme will close and the valuation will crystallise with assets values low due to a depressed market, such that they are inadequate to pay the liabilities. Hence the need for recovery payments to meet the cost of covering this risk.

On the other hand, if the scheme is open indefinitely with a strong covenant, it can be assumed it will never need to close. Therefore asset price volatility is not important. The ability of the scheme to pay benefits depends on there being sufficient investment and contribution income coming in. Therefore market volatility is not a source of risk. There is much less risk and therefore the scheme is cheaper because there is no need to cover it. Also the scheme does not need to invest in 'safe' assets like gilts for the same reason. An open scheme can, and should rationally, invest in assets that bring the highest return.

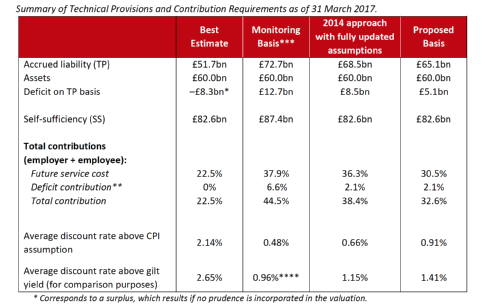

Figue 4 below (from the Technical Provisions Consultation document, September 2017) is the analysis, by the USS executive (not the UCU actuary this time, but the USS exectutive itself under its requirement to provide a fair view of the scheme), of the 'deficit' based on these two different assumptions. On the assumption that the scheme may have to close and therefore must be extremely prudent, so called 'gilts plus', which is the proposed basis, the 'deficit' is £5.1bn. (This has been changed since the TP document was published and is now £7.1 bn. The fact that these figures are so very volatile, with pension liabilities which change very slowly over decades being valued at amounts varying from month to month by billions calls into question the whole methodology.) On the other hand, if the scheme remains open, there is no need to apply a great layer of prudence to all the calculations, and the valuation of the liabilities can be done using the 'best estimate' of the investment returns as the discount rate. On this basis the scheme is massively in surplus, to the tune of £8.3bn!

Figure 4: 'Deficit' or 'Surplus'?

All the efforts of the scheme trustees, the employers and the Pensions Regulator should be devoted to ensuring the scheme remains open. The biggest risk comes from the deficit recovery payments calculated on the basis that the scheme might close. It is therefore a self-fulfilling prophecy. If the scheme is assumed to be ongoing and open then there is little risk.

Risk is not an absolute exogenous quantum as some suggest. It is contextual. And assumptions about it are self fulfilling. The problem with the methodology that is being used is that it is based on an assumption that risk is the same in all circumstances. That is a theory which is false empirically.

Why can't the Pension Protection Fund help?

What is puzzling is that the methodology takes no account of the safety net provided to all pension schemes by the Pension Protection Fund. The USS contributes its share of the levy to this government scheme which guarantees pensions in payment and ensures active members will receive pensions at 90 percent of the DB scheme level.

Why does the USS valuation ignore this? It seems directly relevant since it manifestly limits the risk.

It is said that if the USS entered the PPF it would be too big for it. But the PPF would take on the assets as well as the liabilities. Since the PPF is a government body there can be no problem of it failing to support the schemes in its portfolio, as there is with a private sector employer with a weak covenant. There is no problem with short term market volatility posing a risk.

Therefore we can argue that because the USS is protected by the PPF, a statutory body supported by government, the greatest part of its risk is removed. The valuation should therefore be done without such a large amount of prudence, and therefore the deficit will be much smaller or non-existent. Therefore the scheme is not in danger of failing and of having to enter the PPF.

Can anybody explain why this argument is not being used?

September 15, 2017

USS in Crisis? What is really going on? A message for all USS members.

This is the message sent to members of the USS from the UCU today.

USS in crisis? What’s really going on?

Academic staff in universities within the USS pension scheme have seen their pay fall in real terms since 2009, the cumulative loss to pay (compared to rises in RPI) is over 16%.

There are 53,237 academic staff at Pre 92 universities on fixed term contracts, many of them attempting to build a career.

In this context, the USS pension scheme is a vital and valued benefit for these staff, to some extent offsetting the pressure on pay and careers for these hard-pressed staff.

Since 2011, after 35 years of being a stable pension scheme, USS has been affected by great instability and turbulence.

Successive valuations in 2011 and 2014 have produced notional deficits that have been used to justify cuts to members’ pension benefits, with the closure of final salary pensions to new members in 2011 and then in 2014 the complete closure of final salary, together with the introduction of inferior Defined Contribution benefits for staff currently paid above £55,500.

In both cases, industrial action taken by UCU members staved off the introduction of significantly worse packages.

On 31st March 2017, the latest valuation of the USS scheme produced a notional deficit of £5 billion and the Trustee Board of the scheme indicated that to cover this, the cost of pensions need to be raised by 6 to 7%.

UCU is deeply concerned that if further cuts to pension benefits are proposed it will inject real long term risk into the USS scheme by making it increasingly less attractive to staff.

This is a real threat. USS faces the risk that it will become a decisively inferior package to the Teachers’ Pension Scheme, which staff in new ‘post-92 universities’ pay into. For example, a researcher joining USS at 38 with a 30 year career will receive more than £200,000 less in the USS scheme than they would in TPS over an average retirement.

The scheme is fundamentally sound

UCU argue that the USS scheme is fundamentally sound. Cash flows are positive. The sector is not likely to implode, the employer covenant is robust and the contributions from active members broadly cover pensions in payment. The scheme has £60 billion in assets to back up this situation. It is a ‘last man standing’ scheme where employers share the risk.

However, the way in which USS values the scheme is creating the appearance of a crisis which, the solution to which, ironically, threatens to generate a real long-term problem.

Since 2011, UCU has consistently argued that the USS ‘deficit’ is based on a flawed actuarial model. This model is creating an appearance of a scheme in crisis that then means it invests in more and more ‘safe assets’ which leads to lower returns then it is more expensive in effect a vicious circle.

Creating the appearance of crisis

The USS Board has opted for a valuation methodology based on a set of assumptions that UCU argue undervalues the robustness and unique nature of the USS scheme, which is one of the largest private sector schemes in the UK.

Most fundamentally, the Board has chosen to interpret the Pensions Regulator’s call for ‘prudence’ with unnecessary strictness by insisting on discounting the scheme’s liabilities using a complex measure termed Test 1 which is expressed in terms of the rate of return on government bonds rather than the rate of return on the scheme’s actual mix of assets.

As many commentators and pension experts have noted, this insistence on tying valuations to historically low gilts yields is creating artificially inflated deficits in many defined benefit pension schemes.

UUK is consulting the employers on the draft technical provisions which if accepted would lead to a watering down of benefits for scheme members. UCU argue that more confidence in the sector from employer and its ability to grow and support a decent pension scheme for staff would not only be important in retention but be valuable in recruiting world class academics.

UCU has commissioned its own actuarial analysis from First Actuarial, based on a different methodology, ‘Best Estimate minus’. ‘Best Estimate’ assumes that schemes will continue to pay out benefits as they fall due and make an actuarial best estimate of the future returns they will make on their actual investments, the minus is the introduction of prudence. We believe this methodology better reflects the reality of the sound fundamentals in the USS scheme and the UK higher education sector. Using this produces a surplus rather than a deficit in the scheme and obviates the need for the flawed ‘Technical Provisions’ being proposed.

At the very least, the fact that this is possible demonstrates the wildly different situations that can be generated by small changes in the assumptions being made by the Board.

Given what is at stake, we believe this makes it incumbent on the Board to reconsider this alternative approach in its valuation assumptions.

Summary

The approach being taken by the USS Board may be supported by the Pensions Regulator but the facts remain that:

- their approach has been criticised by significant pensions experts who recognise that it is creating artificial deficits by linking asset values to historically low gilt yields;

- their assumptions are based on a harsh, some might say ‘fantasy’ interpretation of prudence that does not reflect the real performance of actual USS assets;

- the vision of ‘prudence’ is founded on a vision of the UK higher education sector suddenly shutting up shop overnight and winding itself up;

As a result of this, UK higher education employers who have cut staff pay consistently for years have taken fright and indicated they will not raise their contributions any further, leaving hard-pressed academic staff, vast numbers of whom are struggling to build careers on insecure contracts, to pay more or work longer to get a decent pension.

USS shows no sign of deviating from its chosen course and University employers show no sign of willingness to take on extra risk to cover the requirement for increased contributions that will inevitably follow.

Such a situation is highly likely to lead to significant industrial action in the UK higher education sector.

September 05, 2016

Financial Times article arguing that pension scheme response to deficits makes the problem worse

An article in today's Financial Times argues that the conventional approach to pension scheme deficits by "de-risking" and "liability-driven investing" makes the problem worse.

cure_for_uk_pension_funds_deficits_inflicts_more_pain_ftcom.pdf

It makes the same arguments I made in my last blog. See:

http://blogs.warwick.ac.uk/dennisleech/

What the article is saying is directly relevant to the universities scheme, the USS, because it is committing the same mistakes it describes, in common with very many of the 6000 other private sector (because - surprisingly - the universities' scheme is a private sector scheme) schemes.

February 01, 2016

The mystery of the USS

Will the USS have enough money to pay all the pensions that have been promised to members? The answer is that we don't know.

A lot of people assume that, because the scheme has been officially assessed as being in deficit, by its actuaries during the three-yearly valuation process, therefore it must be spending above its income. Just like any business in deficit, it must be having to sell assets or running down its reserves to meet its bills. There are indeed many pension schemes in this situation - but not the USS. In fact the USS is still an 'immature' scheme and very cash generative, making an annual surplus of nearly £1 billion. The misunderstanding is due to language: the word 'deficit' is being used to mean something technical, quite different from its normal sense.

The reported USS deficit refers to the fact that the value of assets is insufficient to cover the estimated liabilities. A better term for this might be 'shortfall'. But saying that there is a deficit in this sense tells us nothing about future cash flows, so there may or may not be a deficit at some future point. It all depends on what happens in the future, and estimates of assets and liabilities do not provide more than the most vague and imprecise indications of that.

To assess the health of the scheme it is necessary to make assumptions about what is likely to happen in the distant future: how long members will live in retirement, when they will retire, their future salary increases, inflation rates, interest rates and investment returns. What is assumed makes a huge difference to the liabilities figure, so much so that it is hard to take the deficit as in any way precise. And it is not unreasonable to believe it does not exist - that the deficit is a statistical artifact that depends on the method used.

For example, take inflation. The USS trustees estimate that for every increase in the retail price index measure of future inflation the liabilities estimate increases by £0.8 billion (£800 million). Their last valuation (for March 2015) assumed a long term forecast for RPI inflation of 3.4-3.5 percent per year into the distant future. But currently inflation is negligible, zero percent. I will leave you to work out how many billions difference it makes whether we use the uSS's so-called 'market based' estimate or the real figure taken from the real market. Or we could generously use the government's official target of 2% CPI (2.7% RPI) - despite the Bank of England's consistently failing to hit it. Either way it illustrates what a wild margin of uncertainty there is in these calculations.

The UCU union and UUK university employers are beginning to look again at this methodology by which the assets and liabilities are estimated. They are examining all the technical assumptions to see if they are not so overly prudent as to create a false deficit. This will be welcomed by all members.

But their review must also answer the question of whether there is likely to be enough money to pay the pensions each year. For that they have to view the scheme as a going concern, with money flowing in and being paid out each year into the foreseeable future. Until that is done whether there is enough money will remain a mystery whatever is decided about the assets and liabilities.

May 20, 2015

Why no legal challenge to the USS trustee?

The pensions regulations place a paramount responsibility on trustees to try and secure the best returns for the members. This has been used as an argument against those who argue that pension funds should not invest in unethical activities such as armaments manufacture, fossil fuels, racism and apartheid, tobacco, and so on. Campaigners have always been told that the only thing that really matters for the trustees is their fiduciary duty and to bring in ethical considerations will go against that.

The same logic ought to govern the overall approach to managing the scheme and not just to the choice of which companies to invest in (assuming the argument is true which I do not - the Church of England investment fund does very well despite having a strong ethical basis). Yet the USS trustee is following a strategy that is not demonstrably in the interests of members just as if it were choosing certain investments for non-financial reasons. If, for example, it decided to divest from cigarette manufacturers, that could well result in lower returns to the fund if the cigarette shares did well. On the other hand, it could make no difference or even benefit the fund if the shares did badly. There is no certainty but the pension fund trustee makes a decision based on what he or she believes.

There is an analogous situation in relation to the whole management strategy at the USS where the trustee is following financial models which have been shown to be wrong rather than their fiduciary responsibility. Whether following the financial models that currently dominate the thinking of the current USS leadership will deliver better returns than pragmatically taking a view about the future or not is a matter of uncertainty. But there surely must be a basis for a legal challenge to a trustee who bases his or her strategy dogmatically on models that have been shown by academic economists and mathematicians to be flawed.

One example is the idea that risk can not only be measured but also managed. That is a very dangerous idea whose consequences we saw during the banking collapse of 2008 when such measured failed. Measures of risk proved to be chimera: of use only when there was little risk but to be unreliable when they were really needed.

Another example is the belief that it is possible to borrow and lend indefinite amounts at the so-called risk-free rate of interest. That might be a reasonable assumption for a small pension scheme worth a few million pounds but is very misleading for a massive scheme as big as the USS, not only the largest pensions scheme in the country but also big enough that its behaviour affects market prices and to have macro-economic effects.

The idea that the returns on an investment can be expressed in terms of its mean and variance, and that the variance measures risk, is not true as a general statement. This is true in the special case where the returns have a so-called Normal (Gaussian) distribution but the statement is not true in general. And it has been demonstrated (by the mathematician Benoit Mandelbrot and others - see Mandelbrot and Hudson, further references to follow) that returns are not normally distributed so it is imprudent, not to say dangerous, to use the model when making real decisions affecting peoples lives. (An excellent critique of financial economics more widely and its role in the 2008 crisis, see Yves Smith, Econned.)

This prompts the question: why, then, do some pensions professionals continue to use models that are flawed and could be dangerous; is that not imprudent? It is a good question to which there is no satisfactory answer. The most likely reason is that the normal distribution is mathematically rigorous and analytically tractable and therefore convenient to use. Results based on it can be described as scientific, objective and so on, and also modern, so there can be an idea of progress. The use of the model has been described as rather like a drunk who has lost his keys in the street and looks for them under the lamp post because that is where the light is.

But that is precisely what the USS trustee is doing. They like to follow the model because it enables them to assume a direct link between risk and mean return. This is the thinking behind their so-called `de-risking proposal' that members are being asked to agree to. Their proposal is that the USS investment strategy is changed (slowly over years) to a lower risk/ lower return portfolio with members agreeing to compensate for the lower return with reduced benefits and higher contributions. But there is no evidence that this will make it more likely that the trustee will be able to pay the pensions promises when they come due. There are compelling arguments that the best strategy could well be to invest to maximise the long-run return. Some actuaries argue against the de-risking idea on precisely these grounds.

There are other examples of the introduction of flawed financial models by the USS trustee which can be challenged. There is an idea among some that assets are only to be considered as random variables following a random walk process. (Again usually based on the application of the normal distribution to ensure analytical tractability.) But investments in real productive assets such as company shares are governed by the real economy. Yet we are told that investing in real productive assets is too risky. Yet long-term we know that there is a substantial so-called equity premium by which shares outperform bonds. A long term investor like a pension fund should be allowed to invest long term since its liabilities are long term. And investment in equities can be seen as contributing to future economic growth if it leads to capital formation.

There is a belief in the idea that markets provide information better than any individual person can. This economic idea, related to the so-called 'efficient markets hypothesis', has been shown to be a fallacy by leading economists (eg Grossman and Stiglitz, American Economic Review, 1980 and others) yet this - what should be authoritative evidence - is ignored by pensions professionals such as the current USS management. Thus, for example, the only way to forecast inflation in the distant future (vital for calculating the pension liabilities) is to look to the market and study the differences between index-linked gilts and others. We are told that such estimates are 'objective'.

And so on. The use of financial models which are flawed in either statistical theory or economics seems to be widespread (though thankfully not universal) in the administration of pension schemes, of which the USS is becoming a leading culprit.

Yet the USS is the pension scheme for the universities. Its members include experts who understand the reasoning and the evidence behind the pensions theory and financial models. We can therefore challenge flawed thinking. We should not accept the suggestion, made, I believe, by someone close the negotiations that such thinking is 'economic orthodoxy'.

I am not a lawyer but I believe there are grounds for at least considering a legal challenge to the trustee on grounds relating to fiduciary responsibility. There is a motion to the forthcoming UCU Congress from the Lancaster University branch calling for such a legal challenge. It is to be hoped that it gets passed and the union takes the necessary action.

May 19, 2015

Ros Altmann the new pensions minister and USS deficits

Just before the election David Cameron announced that the well known independent pensions expert, who was previously the government's Older Worker's Champion, was to be made a Conservative peer. Now she has been appointed pensions minister in succession to the LibDem Steve Webb who had done the job for the whole of the last parliament. Both are experts in their field but they have very different perspectives.

As far as the main question facing the USS, the measurement and management of DB pension fund deficits, is concerned there is a big difference between them. Steve Webb - as was to be expected from one of the Orange Book Liberals for whom free markets are fundamental - was a consistent believer that the deficits computed using market-based ideas are real, and frequently said so. Ros Altmann on the other hand, has been more pragmatic and much less of an economic ideologue. She has, for example, explicitly criticised the USS deficit in an article in the Financial Times, "Scare stories about USS liabilities are overblown".

The article make a number of important points that economic neoliberals like Webb assume away in their belief that the world consists of perfect markets everywhere. For example she says "A fund the size of USS cannot fully de-risk", "Pension funding has become more challenging in a post-quantitative-easing world, where investment risk and mark-to-market pension liabilities have been distorted by Bank of England gilt purchases. This requires a measured, long-term response to pension funding, which can look through shorter-term distortions and readjust over time where necessary. Indeed, switching to bonds at current rates may itself be a `massive bet'.", "Further changes may be required to ensure intergenerational fairness to cohorts of sponsors and members with such a large, open scheme, but this should be negotiated on the basis of long-term forecasts rather than knee-jerk reactions to short-term market factors."

Her appointment probably has little direct relevance to the USS crisis. But it is possible it might lead to a change in thinking about the pensions regulatory system more widely.

May 03, 2015

Required reading about pensions: why are there no error margins in valuations?

This article, "Why are error margins ignored in LDI?", in the latest edition of IPE Investment and Pensions Europe, should be required reading for anybody involved in - or with an interest in - occupational pension schemes. It argues that, in order to be of practical use in guiding decisions, valuations of assets and liabilities should be estimated with a margin of error. This point - that is good science but actually little more than common sense - is directly relevant to the current debate about the universities pensions scheme, the USS, whose trustees seem to be ignoring it completely.

The article says that pension schemes rely too much on financial mathematics for valuations, with its precision leading to a false sense of certainty, and fail to learn the lesson from experimental physics: that margins of error in measurements are just as important as the measurements themselves. We could also say that it is a problem in economic thinking due to too much reliance being placed on the idea that competitive markets are in equilibrium - leading to a belief in precise valuations taken as having the status of fact. Such thinking forgets that in the real world there is everywhere statistical error, which is often a very wide margin. An approximate figure with a wide margin of error is often a more accurate description of reality than one presented with spurious precision.

The article begs the question: why is this issue not being actively discussed by everybody involved in running pension schemes, actuaries, accountants, trustees - and the regulator and the government?

Dennis Leech

Dennis Leech

Please wait - comments are loading

Please wait - comments are loading

Loading…

Loading…